Retirement - An Official Air Force Benefits Website

What Does Federal Retirement Benefits Calculator PIA Mean?

Nevertheless, you are entitled to your "made" annuity, if it is bigger than this quantity. After This Article Is More In-Depth of your high-3 typical wage minus 60% of your Social Security benefit for any month in which you are entitled to Social Security special needs advantages. However, you are entitled to your "earned" annuity, if it is bigger than this amount.

How to calculate my FERS Retirement amount - Government Deal Funding

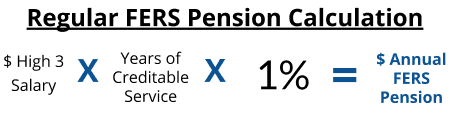

If your real service, plus the credit for time as a disability annuitant equals less than 20 years: 1 percent of your high-3 typical income for each year of service If your actual service, plus the credit for time as an impairment annuitant equates to 20 or more years: 1. 1 percent of your high-3 average income for each year of service Total Service used in the computation will be increased by the amount of time you have actually received a special needs annuity.

Decreases in Special Needs Annuity Survivor Advantages If you are wed, your advantage will be minimized for a survivor advantage, unless your spouse consented to your election of less than a complete survivor annuity. If the total of the survivor advantage(s) you choose equals 50% of your benefit, your annuity is reduced by 10%.

Pin on Retirement Planning

Our Start Planning with our FERS Retirement Calculator - Pinterest PDFs

Unpaid Service if "made" annuity paid If you have a CSRS component in your annuity, the CSRS part of your advantage will be minimized by 10% of any deposit owed for CSRS non-deduction service performed before October 1, 1982, unless the deposit was paid prior to retirement. Expense of Living Adjustments Your annuity will be increased for cost-of-living adjustments, if: You are over age 62; or You retired under the special arrangement for air traffic controllers, law enforcement workers, or firemens; or You retired on impairment, except when you are getting a disability annuity based upon 60% of your high-3 typical salary.

FERS senior citizens under age 62 who do not fall under among the classifications above, are not qualified for cost-of-living boosts till they reach age 62. If you have actually been receiving retirement benefits for less than 1 year and are eligible for a cost-of-living modification, you'll get a portion of the cost-of-living boost.